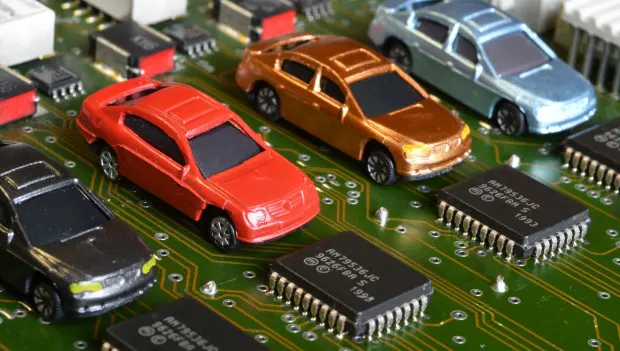

Global Auto Industry Hit by New Microchip Crisis, Losses in the Billions

The global automotive sector is now facing losses in the billions of dollars due to disruptions in critical semiconductor supplies — and those damages continue to mount.

A chain reaction that began in Dutch government offices has, in less than a month, frozen production lines from Europe to Japan. The losses for the global auto industry resulting from disruptions in critical semiconductor delivery already number in the billions and keep growing. Analysts regard this incident as the most severe blow to technology supply chains since the COVID-era chip crisis of 2020.

Source of a Global Problem

It all started on September 30 in the Netherlands. The government, acting with urgency, invoked the “Accessibility of Goods Act,” seizing control of Nexperia — a key semiconductor supplier to the automotive sector.

According to the Ministry of Economic Affairs, the justification for this extraordinary measure was “serious deficiencies in the company’s internal governance,” which posed a direct threat to Europe’s technological sovereignty and economic security.

Effectively, Amsterdam exercised a “golden share,” immediately removing CEO Zhang Xuezheng from his position. Since the Dutch Nexperia, headquartered in Nijmegen, has been under the ownership of Chinese holding Wingtech Technology for years, the government’s action underscores growing EU concerns about control over critical infrastructure.

China’s response was swift and severe. Beijing promptly imposed export controls over semiconductor products produced in Chinese Nexperia facilities — where final chip assembly and packaging take place. In effect, this decision blocked finished chip shipments to Europe and the U.S.

A Wave of Fallout Hits Europe and the U.S.

The domino effect moved fast. Major automakers in Europe and the U.S. found themselves on high alert.

In Germany, Volkswagen officially warned employees of imminent disruptions. Although VW board member Christian Vollmer told Handelsblatt that “alternative suppliers exist,” the company temporarily halted production of the Golf and Tiguan models at its key plants in Wolfsburg to “address inventory supply issues.”

U.S. giants Ford and General Motors, along with Europe-based divisions of Toyota and Hyundai, are closely monitoring the situation and reviewing inventory reserves. Analysts warn that many automakers have only weeks of buffer stock — and production lines may grind to a halt before year’s end.

A Threat to Japan’s Auto Industry

The crisis is now encroaching on Japan, demonstrating that no industry is immune in this era of globalization. Even Japan’s leading automakers — Nissan and Honda, celebrated for their streamlined supply chains — are under direct threat.

Insiders report that both companies are actively modeling emergency plans, including reduced work shifts and temporary shutdowns of key assembly lines on the home islands.

A New Financial Paradigm: Yuan Over Dollar

As Western automakers scramble to contain the shock, Nexperia’s Chinese arm resumed chip deliveries — but exclusively to domestic buyers and under drastically new terms.

The major shift: all transactions will now be settled in Chinese yuan. Previously, the company denominated international trade in U.S. dollars. This move by parent firm Wingtech Technology aims to both stabilize domestic supply and establish greater financial and operational autonomy from the Dutch asset now under the government’s influence.

What Lies Ahead

The Nexperia crisis has evolved from a corporate incident into a full-scale geoeconomic conflict, spotlighting three fundamental shifts:

-

Supply chain security is now a matter of national security. Governments are prepared to intervene directly in private enterprises to protect strategic industries.

-

Technological dependency is now a systemic risk. Deep integration with Asian manufacturers — long seen as a performance advantage — has become a chief vulnerability for Western automakers.

-

The global market is fragmenting into competing technological and financial blocs. The shift to yuan-based settlement in a single company illustrates a macro trend: the world is cleaving into separate spheres of influence.

Restoring manufacturing operations may take weeks or months. But rebuilding trust in global supply chains and forging a more resilient business model will require far longer. The Nexperia crisis is not an aberration — it may well be the new normal for the global industry.

You may also be interested in the news:

Toyota Partner Begins Construction of Solid-State Battery Plant: Electrolyte Promises 620 Miles of Range and 10-Minute Charging

For many years, Japan’s Toyota has promised to bring solid-state battery electric vehicles to market, and now that long-running story is starting to take on real shape.

Volkswagen Confirms New Tiguan Launch in March — Seven-Seat Version Dropped

The model will no longer have major regional differences and will become a single global product.

NHTSA broadens investigation into roughly 1.3 million Ford F-150 trucks over transmission concerns

U.S. safety regulators widen scrutiny of Ford F-150 pickups after complaints of transmission downshifts that could increase crash risks.

Rare Nissan Skyline GT-R M-Spec Nür Sells for $442,000 at U.S. Online Auction

Nissan built just 285 examples of the Skyline GT-R M-Spec Nür, making it one of the rarest production versions of the R34.

Ford and Xiaomi Deny Rumors of Joint EV Production in the U.S.

Speculation about a potential partnership between America’s Ford and China’s Xiaomi intensified after a report published by the Financial Times.