Former Nissan and Mercedes Plant in Mexico May Be Sold to Chinese Automakers: What We Know

The COMPAS facility in Mexico, officially set to close in May 2026, could be acquired by Chinese manufacturers. Here’s what we know about the potential deal.

Chinese automakers Chery, BYD, Great Wall Motor (GWM), and Geely have made the shortlist of four finalists bidding to purchase the Cooperation Manufacturing Plant Aguascalientes (COMPAS), a joint venture between Nissan and Mercedes-Benz in central Mexico. The facility is scheduled to shut down in May 2026.

According to China’s Sina, the potential acquisition of the plant—whose annual production capacity stands at 230,000 vehicles—would align with Chinese automakers’ broader strategy to localize manufacturing operations in North America amid the restructuring of global automotive supply chains expected in 2026.

The COMPAS plant, which opened in 2017 as a joint venture between Nissan and Mercedes-Benz, is set to cease operations amid shifting market conditions and tariff pressures. Unofficial reports suggest that nine companies initially expressed interest in acquiring the facility. Among those publicly named are China’s BYD, Geely, Chery, and Great Wall Motor, as well as Vietnam’s VinFast, which has also advanced to the final negotiation stage.

Chinese sources indicate that at earlier stages of discussions, other major Chinese automotive groups—including SAIC Motor—were also mentioned as potential buyers.

For decades, Mexico’s automotive sector has been heavily export-oriented, with the United States absorbing a significant share of locally produced vehicles. However, recent U.S. tariff policies have slowed production and contributed to job losses, prompting industry leaders and Mexican policymakers to weigh the potential economic benefits of new foreign investment against broader trade headwinds.

This competitive bid differs from previous attempts by Chinese automakers to build new factories from the ground up in Mexico—plans that were put on hold due to regulatory and geopolitical uncertainty. Acquiring an existing facility like COMPAS could provide a faster path to localized assembly, enabling manufacturers to serve both domestic and export markets without the lengthy permitting processes typically required for greenfield projects.

The surge of Chinese interest also reflects the rapid expansion of Chinese brands across Latin America. Consulting data and market indicators show that Chinese automakers’ share of Mexico’s car market has grown from negligible levels in 2020 to roughly 10% by 2025—underscoring how export dynamics are influencing long-term production capacity decisions, beyond simply increasing vehicle sales.

If one of the Chinese automakers ultimately secures the plant, it would mark the establishment of a direct manufacturing foothold in one of the world’s major automotive hubs outside Asia. A final decision is expected in the coming months.

You may also be interested in the news:

Toyota RAV4 2026 Production Begins in Canada for the U.S.: Crossover Goes Hybrid-Only in North America

Assembly is ramping up at the Woodstock, Ontario plant, with crossovers destined for U.S. customers.

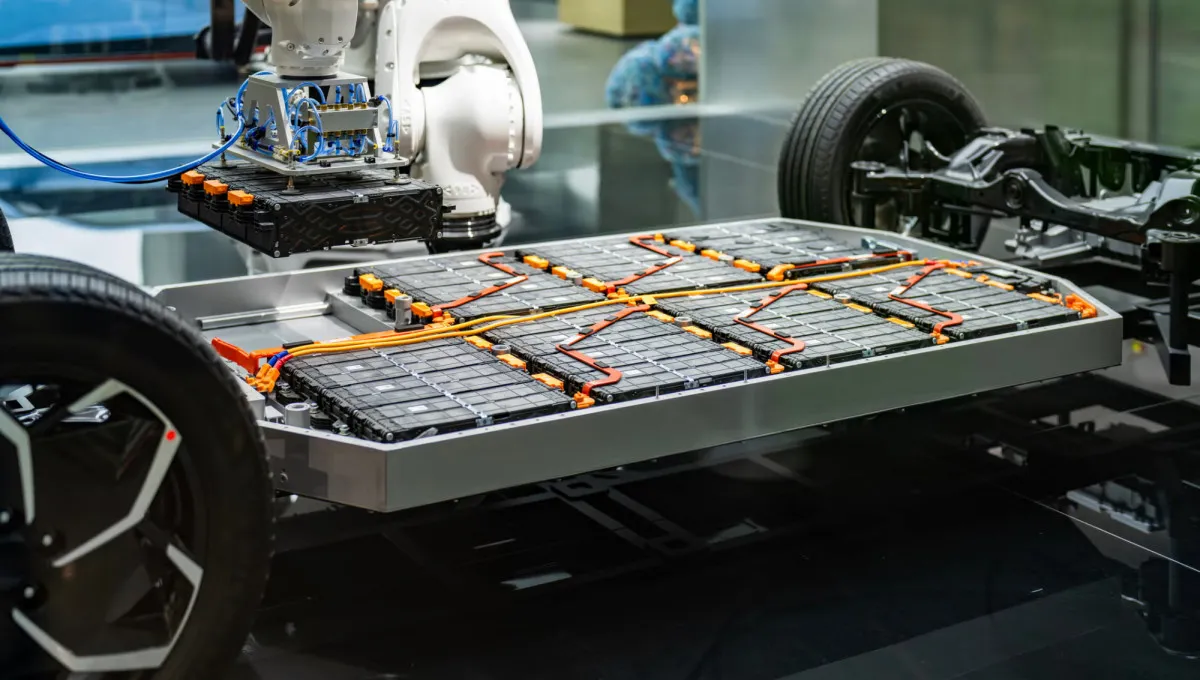

Setting the Direction at Home — Then Worldwide: China to Approve Solid-State Battery Standard

China is set to release its first national standard for solid-state batteries in July 2026, as the country prepares for mass production next year.

Rivian Gears Up for R2 Rollout as Early Testing Reveals Average Charging Speeds

Rivian is nearing the start of deliveries for its highly anticipated R2 electric crossover.

Do You See the Resemblance Too? Meet the Chinese Foton Tunland G9 Pickup

The midsize Foton Tunland G9 pickup stands out with a surprisingly modern design—though it looks oddly familiar.

Toyota Boosts Vehicle Sales to 7.3 Million, but Profit Falls 26% on Higher Costs and Currency Swings

Toyota Motor has released its consolidated IFRS results for the first nine months of fiscal year 2026 (April 1 to December 31, 2025).