Chinese LFP Battery Market: New Players Challenge the Leaders

CATL and BYD Lose Leadership: Battery Installation Ranking in China for the First Half of 2025

According to the China Automotive Battery Innovation Alliance (CABIA), the total volume of installed traction batteries in the Chinese market for the first six months of 2025 reached 299.6 GWh, which is 47.3% higher than the result for the same period last year. In absolute terms, the growth amounted to almost 96 GWh, which became the highest half-year result in the alliance's observation history.

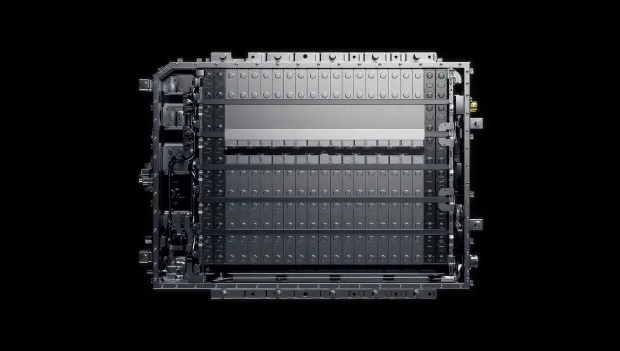

Chinese Battery Market: Top-10 Manufacturers

The first place is still held by CATL (Contemporary Amperex Technology Co., Limited), which installed 128.6 GWh of batteries. This corresponds to a 43.05% share of the total volume. However, compared to January-June 2024, the manufacturer's position weakened by 3.33 percentage points. Of the total volume, 38.81 GWh accounted for NCM (nickel-cobalt-manganese) batteries, and 89.79 GWh was for cheaper and more thermally stable LFP (lithium-iron-phosphate).

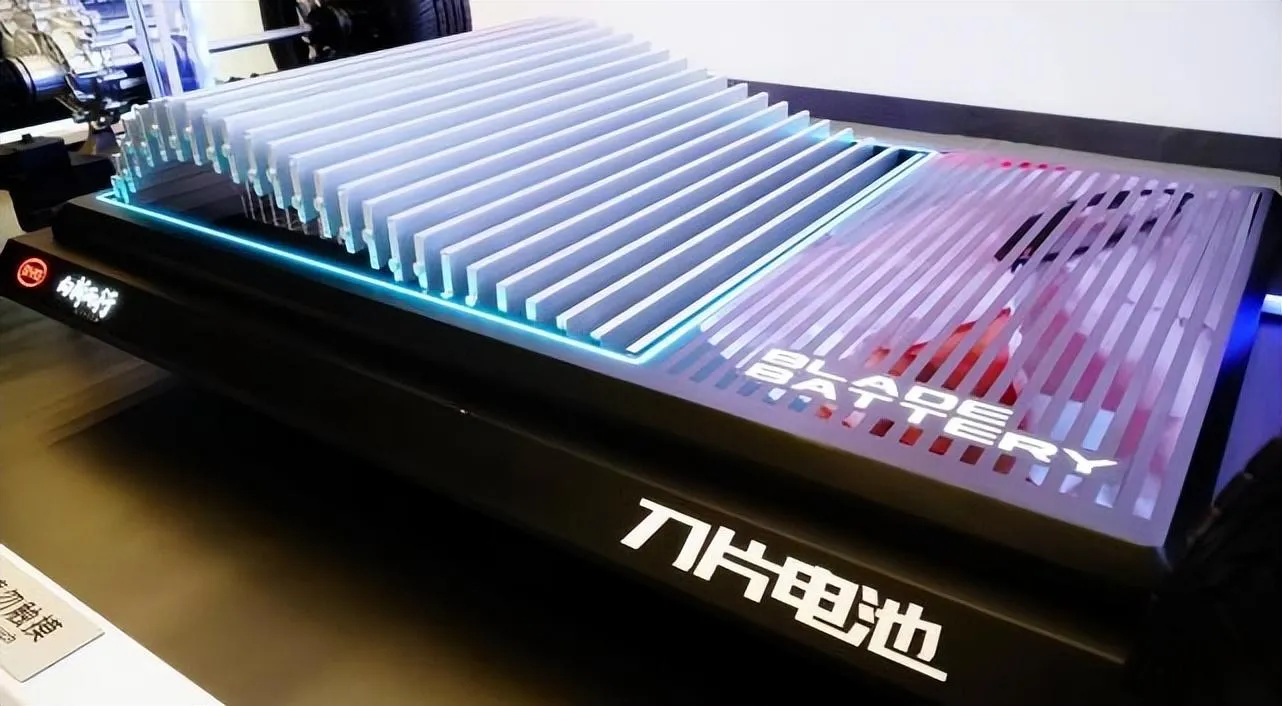

The second place is occupied by BYD, whose installations amounted to 70.37 GWh. This is 23.55% of the market, minus 1.55 percentage points year-on-year. Almost the entire volume was LFP cells, including the well-known Blade batteries, while the NCM share amounted to only 0.02 GWh. Thus, the two leaders together control 66.6% of the market, which is 4.88 percentage points less than a year earlier.

CALB (China Aviation Lithium Battery) ranks third with 19.46 GWh. Of these, 5.85 GWh are NCM, and 13.61 GWh are LFP. Gotion Tech holds the fourth place with 15.48 GWh. The company increased its share by 1.62 percentage points, installing 0.29 GWh NCM and 15.2 GWh LFP. The fifth position belongs to EVE Energy with 12.21 GWh, including 0.52 GWh NCM and 11.7 GWh LFP.

Sunwoda takes the sixth place with 9.07 GWh, of which 1.06 GWh is NCM and 8.01 GWh is LFP. The seventh result goes to Svolt Energy, part of the Great Wall ecosystem: 8.4 GWh, including 3.13 GWh NCM and 5.27 GWh LFP. Rept Battero ranks eighth, focusing entirely on LFP with 6.59 GWh. The company improved its share by 0.35 percentage points. Zenergy is ninth with 5.95 GWh, of which 0.23 GWh is NCM. Completing the top ten is Jidian, associated with Geely: 4.23 GWh exclusively based on LFP.

In June, the top ten manufacturers provided 94.2% of all installations, 1.8 percentage points less than in June 2024. For the half-year, the top ten companies captured 93.6% of the market, compared to 96.1% a year ago. This confirms a trend of gradual deconcentration: despite the dominance of the largest players, new or previously little-noticed participants are finding their place.

Analysts from the Chinese automotive publication CNAutoNews note that automakers are striving to reduce dependence on CATL and BYD due to rising production costs of electric vehicles. Transitioning to alternative suppliers helps restrain prices and enhance supply chain flexibility. Notably, the inclusion of Svolt and Jidian in the top ten, which belong to Great Wall and Geely respectively, demonstrates that major auto corporations are developing their own battery divisions and are ready to share orders with external clients. This may accelerate market diversification in the second half of 2025.

You may also be interested in the news:

American Buys the “Worst EV in the World” — and Is Shocked by Its Real-World Range

The road test didn’t go smoothly, and the driver ran into several unexpected problems along the way.

Gotion’s Jinshi Batteries Promise 620 Miles of Range and 10-Minute Charging

Gotion High-Tech launches a 2 GWh solid-state battery production line.

Two-Story House on Wheels with a Unique Living Area

A new double-decker RV with a rooftop terrace — and a surprisingly attractive price tag.

Xiaomi Vision GT Presented in Barcelona: A Supercar for Gran Turismo

Xiaomi is preparing its entry into Europe through virtual racing

Six of the Most Resale-Friendly Non-American Crossovers Popular on the U.S. Market

The crossovers with the strongest resale value in today’s American market.